Blog

Wednesday, June 5, 2024

As an Etsy seller, understanding the nuances of accounting and maintaining a clear perspective on your financial health is crucial, especially during high-volume sales periods like the holidays. However, many sellers struggle with accurately calculating their profits after taking into account expenses such as packaging, labor, materials, and marketing. A common mistake is using a cash-based accounting system, which does not always paint a complete picture of an Etsy store's financial health.

The Tale of Two Etsy Accounting Methods: Cash vs. Accrual

There is key differences of analyzing your Etsy shop in a cash vs accrual method. Let's examine the case of Hannah looking at her shop from a cash basis. She reported $20,000 in sales last month. In preparation for the holiday rush, she also incurred $20,000 in expenses to restock and increase her inventory, her Etsy ad spend, fees, etc. At first glance, using a cash-based accounting method, it would appear that Hannah made no profit because her expenses equaled her income. However, this method can be misleading for businesses that deal in physical goods.

Why Accrual Accounting Suits Etsy Sellers Better

Accrual accounting provides a more accurate reflection for businesses that deal in physical goods. Under this system, costs are recognized when goods are sold, not when inventory is purchased or manufactured. This method provides a clearer picture of profit and loss during a given period by matching revenue with the associated cost of goods sold (COGS), regardless of when the money changes hands. In the example above where Hannah seemed to make no money on a cash basis on an accrual basis Hannah probably was profitable. If she only expensed the items that did sell and not all the items she bought that month to sell there would be a more accurate representation of profit.

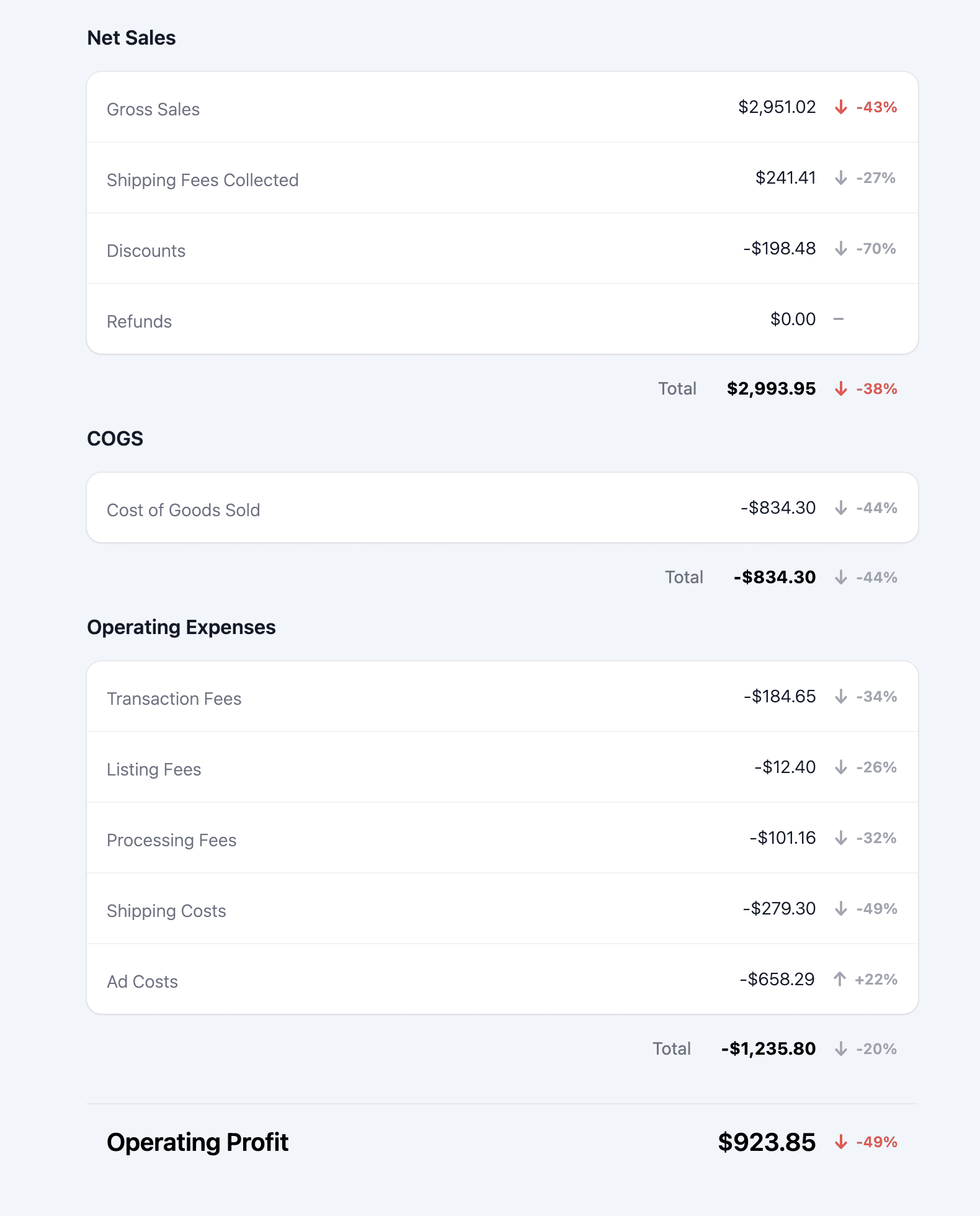

Here is what a simple healthy Etsy accounting statement should look like:

Implementing Efficient Tracking Methods

Accurately tracking products and sales is critical to implementing accrual accounting. This can be effectively managed with a few strategic systems and tools.

The Importance of SKUs

A SKU, or Stock Keeping Unit, is a unique identifier that helps track each specific product sold. Using SKUs allow you to understand which products are performing well. If you're new to this concept or need to refine your SKU system, look for resources or tools that can help you set up a comprehensive SKU system for your business.

Click the video below!

Streamlining with Technology

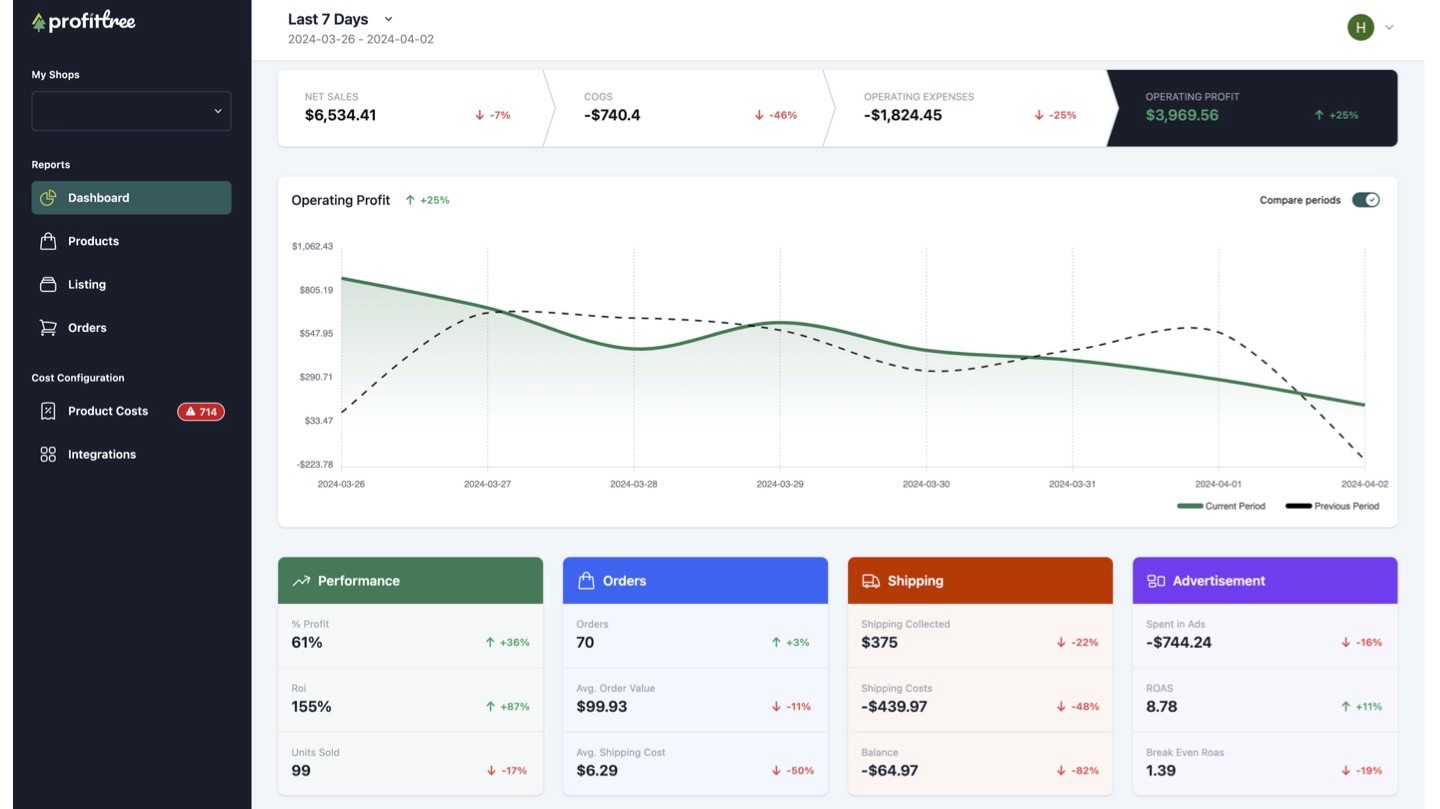

Platforms like ProfitTree provide robust tools for sellers to track profit whether they utilize the SKU or not. By entering product costs into ProfitTree, sellers can track COGS on a per-sale basis. This feature is especially useful for sellers who use print-on-demand services like Printify or Printful, as these platforms can integrate directly to pull in detailed cost data.

The Advantages of Accurate Cost Tracking

Understanding detailed product cost breakdowns transforms not only the accounting aspect of your business, but also strategic decision-making.

Gaining a Bird's-Eye View of Financial Health

With accurate tracking, you can get a complete picture of your company's financial health. This includes identifying which products are selling well, which are not, and the profitability of each item. Tools that provide a dashboard view of these metrics can greatly enhance your ability to make informed decisions quickly.

Enhanced Strategic Decision-Making

Armed with detailed insights from your accrual accounting and SKU systems, you can more effectively determine which products to focus on, where to cut costs, and how to optimize your marketing spend. This level of detail keeps your business strategy agile and responsive to market changes and consumer trends.

Leverage Technology to Boost Your Etsy Business

Platforms like ProfitTree are not just tools; they're gateways to maximizing your Etsy store's potential.

In conclusion, moving from a traditional cash-based accounting method to an accrual-based system, supplemented by the effective use of SKUs and platforms like ProfitTree, can significantly empower Etsy sellers. It helps to track Etsy profits more accurately, which ultimately helps to make smarter business decisions and drive growth.